Home Page

I want to...

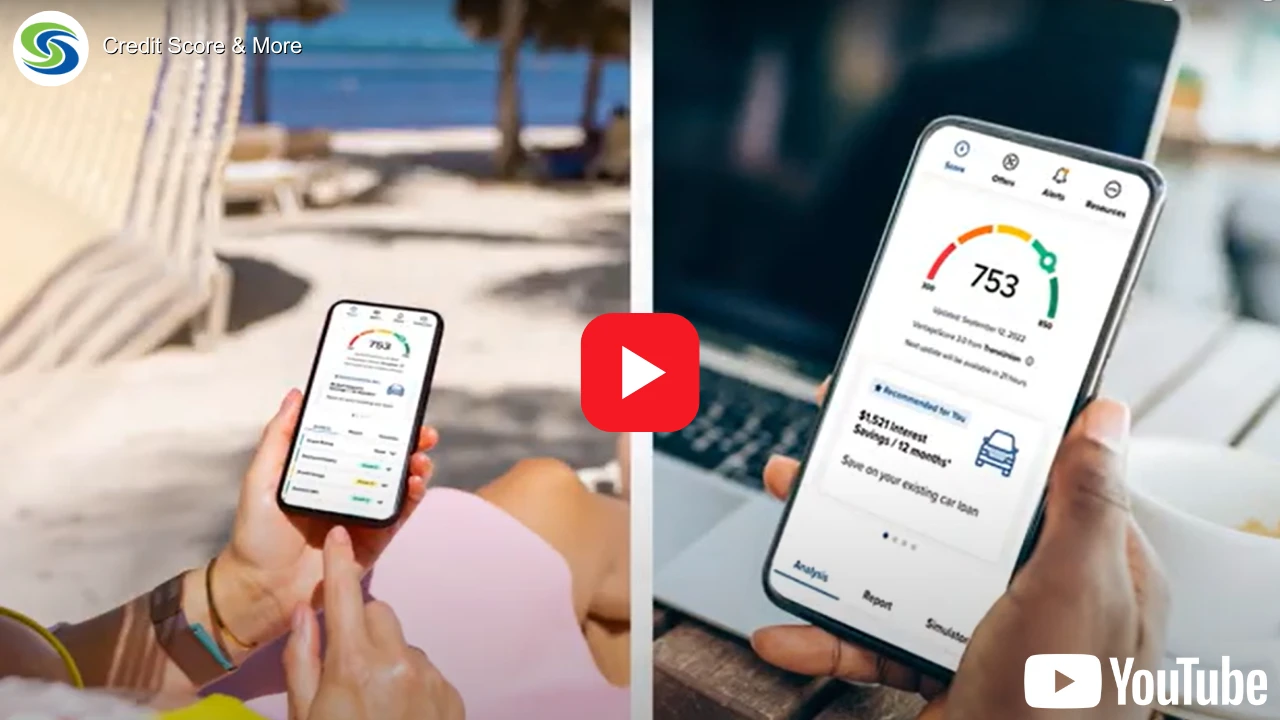

Credit score & more

Staying on top of your credit has never been easier. Log into mobile or online banking to use this FREE service and enroll.

Mortgage pre-approval made easy

Get pre-approved with SCU Credit Union's Smart Start Program. Down payments starting at 3%, up to $1,000 closing costs credit, and fast processing.

trending blog posts

Simplify your savings journey with SCU Direct

Your savings grow effortlessly with flexible, systematic transfers while building strong financial habits. Earn up to 4.00% APY1

Investing in tomorrow

The Boys & Girls Clubs of Metro South, in collaboration with SCU Credit Union, are dedicated to empowering youth across Southeastern Massachusetts.

This partnership aims to provide essential programs and opportunities that foster personal growth, academic success, and the development of leadership skills.

From our members

See what our members have to say