Improve my Credit

Having a good credit score can unlock access to favorable loans and rewards on credit cards while saving you money through better rates. On the SCU app, you can get your current score and personalized advice on how to improve it. All for free. All for you.

Understanding credit score

Your credit score is a number 0-850 used by lenders to determine your trusworthiness to pay back debt on time. The higher your score, the more trustworthy you are to these lenders.

Importance of having a good credit score

Save money through better rates

Access to rewards-based credit cards

Building strong financial habits

Track your credit score anytime, anywhere—for FREE with SavvyMoney!

Discover how easy it is to stay on top of your finances with the SavvyMoney Credit Score tool. Get daily access to your credit score, a personalized credit report, real-time monitoring alerts, and even explore a credit score simulator to plan smarter financial moves.

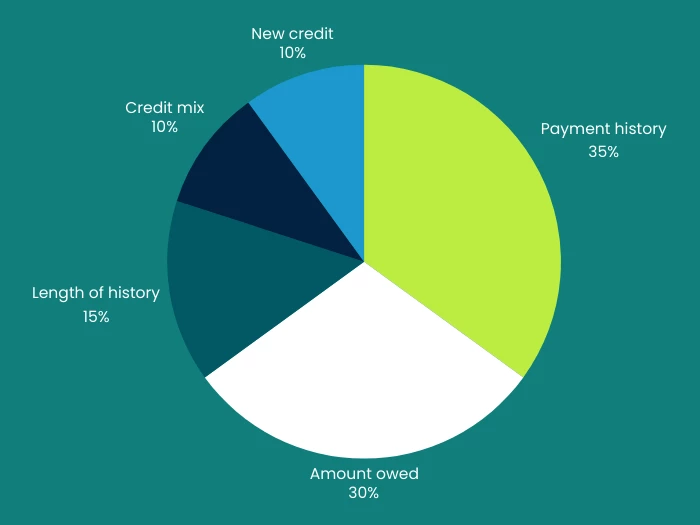

- Payment history - are you making at least minimum payments on time?

- Amount owed - using less than 30% of your credit limit is recommended

- Length of history - the longer you've been using credit, the better

- Credit mix - do you have a mix of credit usage that highlights your responsibility

- New credit - too many new inquiries in a short window can look suspicous to creditors

Establish responsible credit habits and gain financial confidence with a secured credit card.

Here's how it works: You simply deposit money into a share savings account. This deposit becomes your credit limit, giving you the flexibility to make purchases while building your credit.

learn more about our Platinum Secured credit card learn more about our other credit cards