First-Time Homebuyer

We provide personalized mortgage options and expert support to help you buy your first home with confidence.

The right mortgage lender can make all the difference.

Not all mortgage rates and fees are created equal, and taking the time to compare can lead to significant savings over the life of your loan. Our loans are serviced in-house, ensuring that help is always nearby when you need it. As trusted local lenders who understand the market, we are dedicated to providing personalized support every step of the way. Let us help you turn your homeownership dreams into reality.

Flexible Fixed and Adjustable Rate Options

Choose a Fixed Rate Mortgage for predictable payments or an Adjustable Rate Mortgage (ARM) to start with lower initial payments.

Fixed Rate Mortgages

- Stable, predictable monthly payments for the life of your loan.

- Protection from rising interest rates, providing peace of mind.

- Choose from a variety of term lengths—10, 15, 20, or 30 years—to match your financial goals and timeline.

Adjustable Rate Mortgages

- Flexibility to adjust to market conditions, offering potential savings in the initial years of the loan

- Competitive interest rates that can be lower than fixed-rate mortgages, making homeownership more affordable

- Ideal for first-time homebuyers or short-term homeowners, with lower initial monthly payments to ease budgeting

Why Choose SCU Credit Union?

We service mortgages locally, meaning your loan stays with SCU Credit Union—from origination to servicing.

We proudly serve local communities, offering convenient locations in Sharon, Mansfield, North Attleboro, Foxboro, East Walpole, Taunton (two branches), and Brockton (four branches). Our team is ready to help you achieve homeownership with competitive rates, no hidden fees, and unmatched personalized support.

learn more check mortgage rates apply online connect with a mortgage consultant

Whether you are a first-time homebuyer, planning to upgrade your current home, or looking to downsize, this seminar is designed to provide you with valuable insights and guidance throughout the home buying journey. Our knowledgeable speakers will cover these topics comprehensively, providing you with a clear understanding of the steps involved, the importance of credit, the roles of key professionals, legal considerations, and how SCU Credit Union can support you throughout the process.

Get pre-approved with SCU Credit Union's Smart Start Program. Down payments starting at 3%, up to $1,000 closing costs credit, and fast processing.

Mortgages

Highlights

Homeownership starts here.

At SCU Credit Union, we offer competitive mortgages with personalized, local service for residents in Massachusetts and Rhode Island. First-time buyers, those refinancing, and homeowners seeking guidance are welcome!

Float down your interest rate once, at no additional cost.

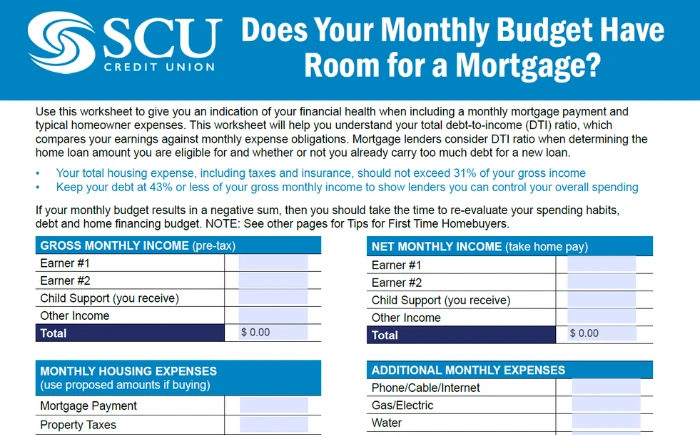

Does your monthly budget have room for a mortgage? Buying your first home is exciting, but it also means taking a careful look at your finances. Our First Time Homebuyer Worksheet is designed to help you understand how a mortgage payment fits into your monthly budget and whether you’re financially prepared for homeownership.

Mortgage | Frequently Asked Questions

Your mortgage resource toolkit

A trove of tools and tips to transform your finances

Resources