Protect Your Money

Your hard-earned money deserves the best protection, and at SCU Credit Union, we’re here to provide it. With us, your money is 100% safe. 100% insured.

By banking with SCU Credit Union, you’re not just saving—you’re securing your family’s financial future. Your deposits are federally insured, which means your money is protected no matter what. Whether you’re saving for your first home, building an emergency fund, or planning for retirement, we’re here to give you the peace of mind you deserve.

Your money is 100% safe. 100% insured.

SCU Credit Union is insured by both the National Credit Union Association (NCUA) and Massachusetts Shared Insured Corporation (MSIC). Your money is 100% insured regardless of the amount at SCU Credit Union. MSIC provides Excess Share and Deposit Insurance to all members of SCU Credit Union automatically. The coverage is a benefit of membership and comes at no direct cost to you. MSIC insures the portion of any legal, verifiable share or deposit account that exceeds NCUSIF coverage with no limit.

SCU Credit Union will never ask you to divulge the following information over the phone or through an email:

- Credit or debit card information, including account numbers and expiration dates

- Social Security numbers

- Deposit account numbers

- User names and passwords

Here are some tips to avoid phishing scams:

- Do not reply to emails or internet pop-up messages that ask for personal or financial information

- Do not click any links contained within an email that you believe to be suspicious

- If you receive a suspicious email or phone call, check the validity of the message by contacting the business using a phone number you know is real

- Do not send personal or financial information in an email or email attachment

Linking your SCU Credit Union Debit Mastercard with a Digital Wallet is a smart move towards a more convenient and secure financial experience.

Advanced security features, such as tokenization and biometric authentication, to protect your financial information and offer a safe and convenient transaction experience.

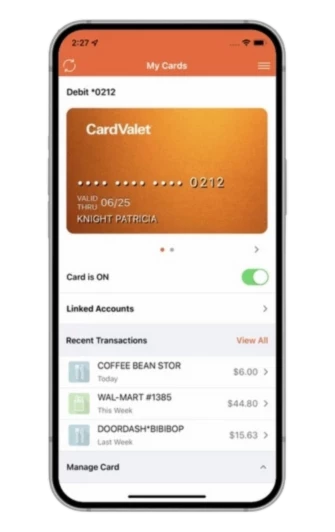

Enjoy Peace of mind and guard Against fraud. Take advantage of these great features:

- Turn your Debit Mastercard® on and off

- Receive alerts when your Debit Mastercard® is used

- Establish controls for dollar amount, merchant categories and geographic locations

Start managing your card with ease and enjoy the benefits of secure, stress-free transactions.

EnFact Fraud Detection

To protect your account SCU monitors debit card transactions for potentially fraudulent activity using Enfact Fraud Detection. If we see suspicious transactions, you'll receive a text message with details about the suspected transaction. You will only need to reply Yes or No to the text. Never provide account information.

We may call….

If we can’t reach you by text. Simply provide your Zip Code and if the transaction is fraudulent, you will be connected with an agent.