Remote Deposit Capture allows you to deposit most checks through mobile banking. Checks not drawn on U.S. banks and/or not U.S. funds cannot be deposited through Remote Deposit Capture.

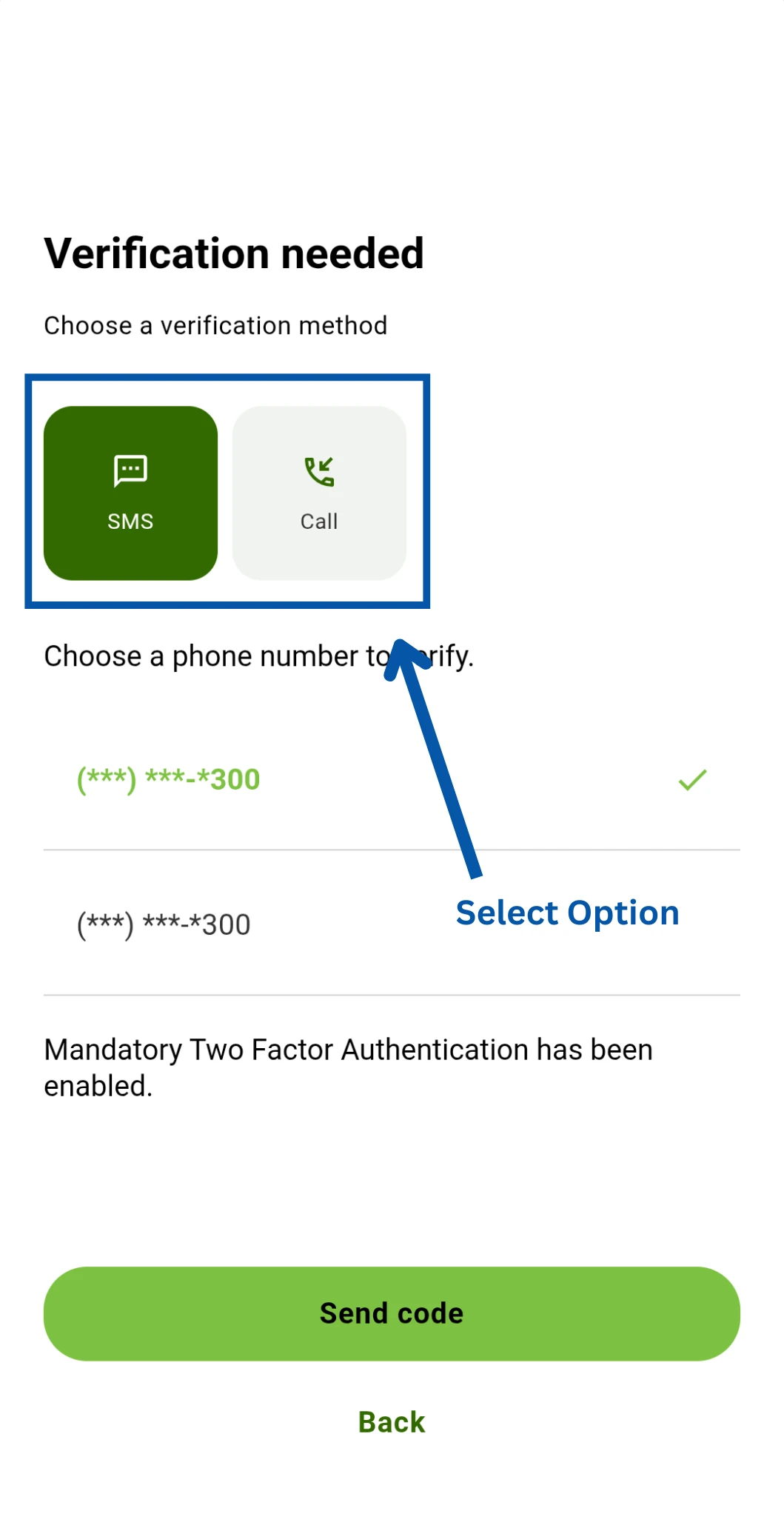

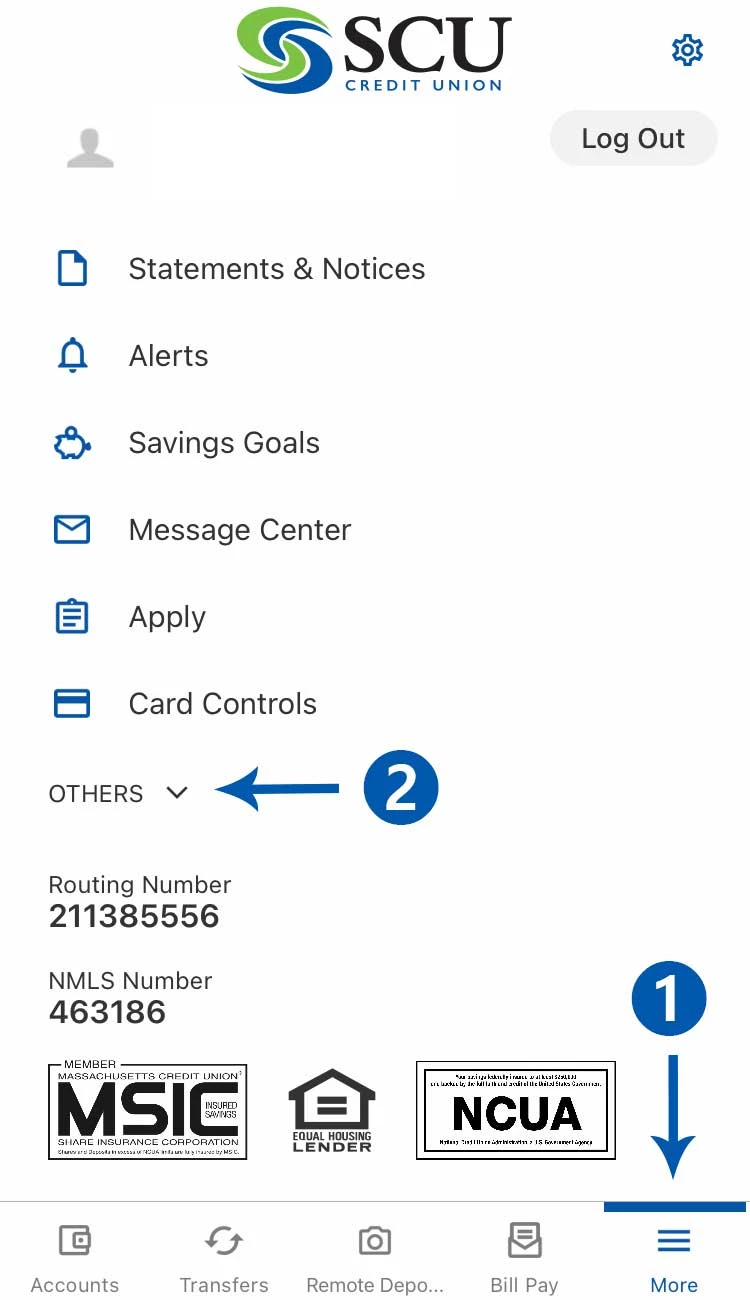

- Open the mobile banking app.

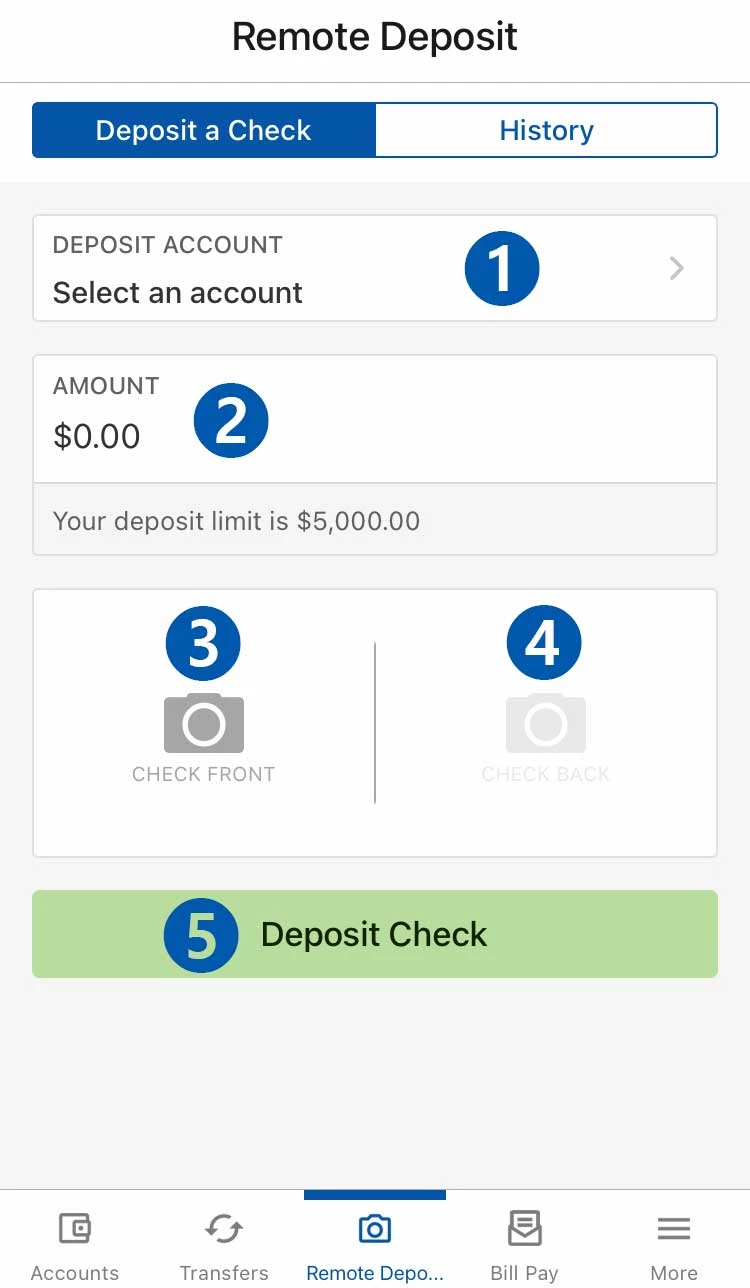

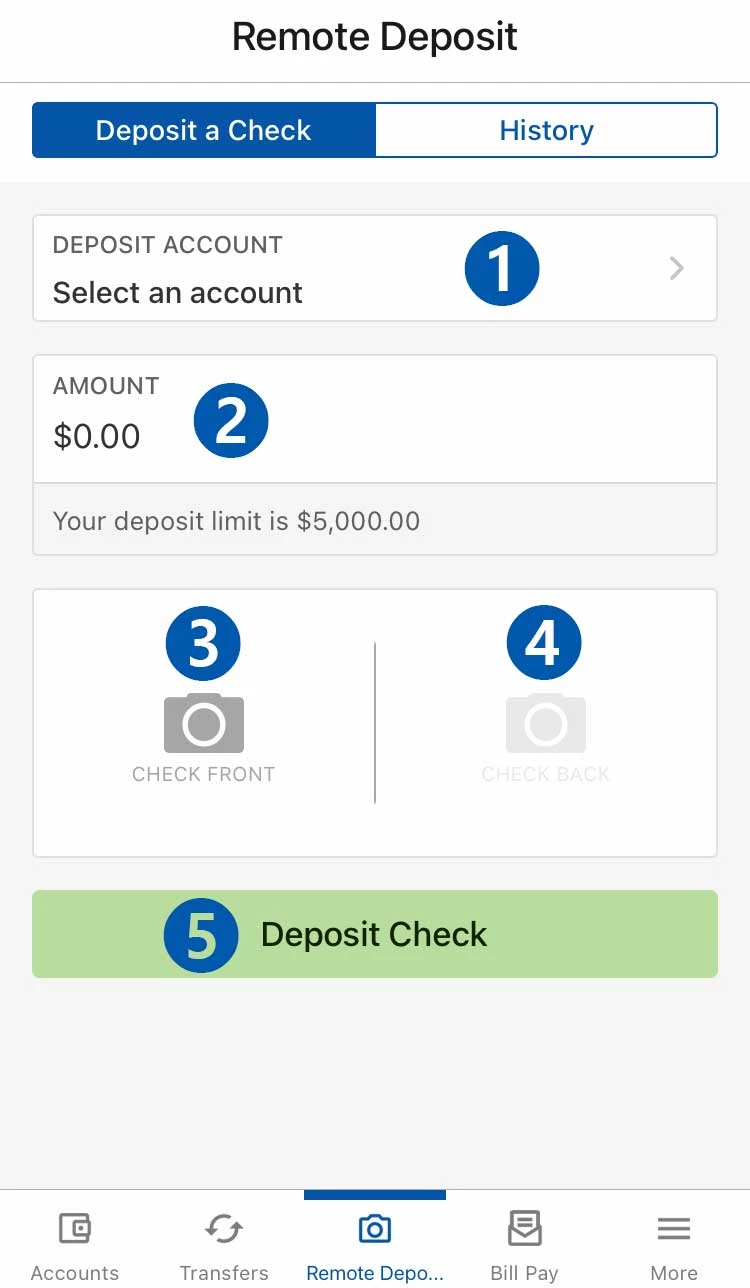

- Click Remote Deposit at the bottom of the screen.

- Select which account you want to deposit the check into.

- Type in the exact amount of the check.

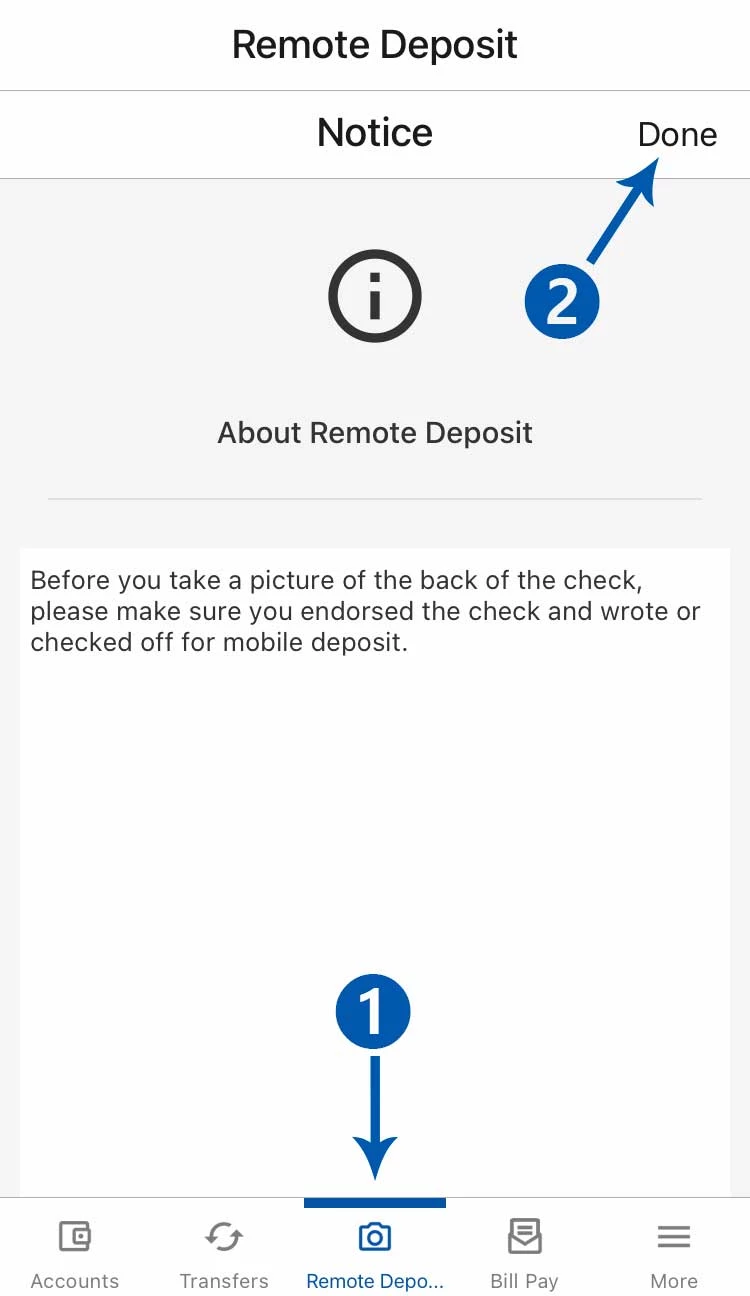

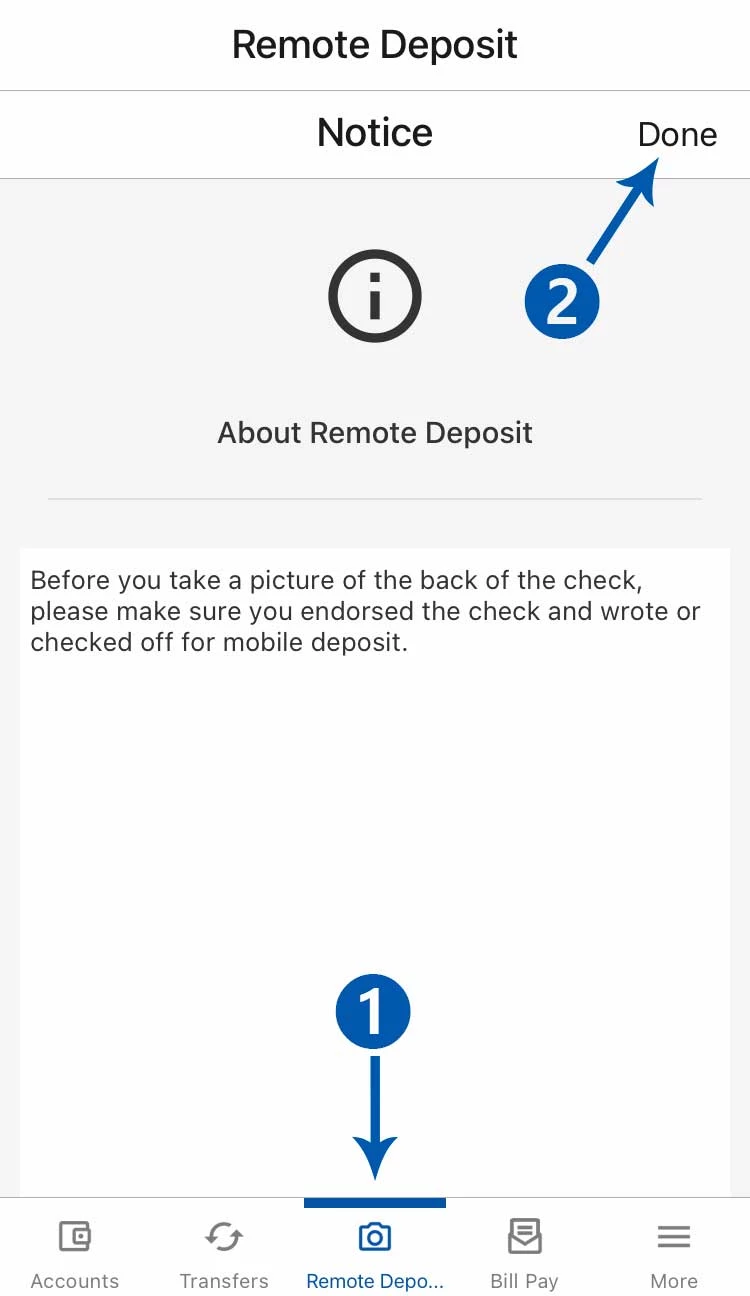

- Endorse the check and write "For Mobile Deposit at SCU" below your signature (or, if available, check off For Mobile Deposit).

- Click Check Front. If you see "Prepare the front of the check", select continue in the bottom right of the screen. Align the check within the box and tap the screen to take the picture. If the picture is clear, click Done. If you need to retake the picture click the trash can icon.

- Click Check Back and repeat the same process to take a picture of the back of the check.

- Click Deposit Check.

- After depositing a check remotely we recommend retaining the check for a minimum of three (3) business days after the deposit is credited to your account and it appears in your transaction register in Online and Mobile Banking. Then, destroy the original check by shredding.

You will receive an email indicating your deposit has been accepted, held for review or rejected. To avoid duplicates, please do not resubmit a deposit unless you receive an email indicating further action is necessary.

In most cases, funds from approved deposits are available immediately. If your deposit is held for review and you submitted it before 2 p.m. EST on a business day, the check will be processed that same day. All deposits are subject to the SCU Credit Union Funds Availability Policy. Deposits are subject to verification.